vs. SAR 9,631 million in 2021.

From farm to table, Almarai is the world’s largest vertically integrated dairy company, operating across the value chain and throughout the region. Starting in our world-class farms and facilities in the heart of Saudi Arabia, with state-of the-art production, processing and distribution operations, our diverse range of high-quality products are delivered to more than 100,000 customers within the Kingdom and across the GCC, Egypt and Jordan every day.

Delivering quality products to consumers across the Kingdom is at the heart of our promise and the foundation of our role in ensuring food security for the Kingdom. Millions of consumers depend on us each day to provide them with the highest quality, most nutritious dairy, juice, bakery and poultry products in the market. We repay this trust and loyalty through continuous consumer-focused innovation to ensure that every bite or sip of an Almarai product promotes health and wellness in line with our customers’ evolving needs.

Almarai’s Dairy business unit exceeded both profit and market share targets in a challenging 2022, thanks to consistent and thorough implementation of its proven strategy, specifically driving efficiencies and developing channels to market.

Throughout 2022, Almarai Dairy demonstrated its brand strength and resilience by delivering increased revenues despite much higher input costs. The impact of the global pandemic continued to affect the entire dairy industry, leading to unprecedented commodity prices, a steep rise in freight charges, and supply chain disruptions.

Almarai’s concerted effort to mitigate these headwinds included maintaining its focus on its GCC markets, strengthening its core categories, implementing efficiency initiatives particularly in long life (UHT) milk, and making improvements in the portfolio mix.

In the core fresh dairy category, milk, laban and zabadi performed strongly, delivering revenue growth of 13%, 16% and 14% respectively in the Kingdom. There were also excellent performances from our UHT milk, butter and spreadable cheese products, which increased revenues 31%, 23% and 17% respectively. The numbers will change as we are seeing an improved performance on core in Q4.

(Dec 22 MAT)

| Market Share | Market Position |

|---|---|

Laban:63.8% |

1 |

Fresh milk:65.3% |

1 |

Zabadi:63.7% |

1 |

UHT milk:19.9% |

2 |

Continued Innovation and Expanding Capabilities

In addition, Almarai expanded its capabilities in its e-commerce channel, which resulted in a robust 13% increase in revenues. The key drivers behind the impressive growth were increased investment in infrastructure in the key regions and continued expansion of outlet coverage and service. Almarai will continue to invest in the channel to realize its high double-digit compound annual growth rate (CAGR) outlook.

During the year, the Dairy business unit continued its programme of product innovation and development to cater to emerging consumer needs and to enter new segments. We invested in enhancing our consumer knowledge across multiple product segments to inform product development and positioning.

Product and segment development was complemented by ongoing investment in next-generation packaging innovation to support our abiding commitment to improving functionality and consumer experience. All new products are tested rigorously according to sophisticated methodologies to ensure that they receive consistently high ratings from consumers, and particularly when compared to competitor offerings.

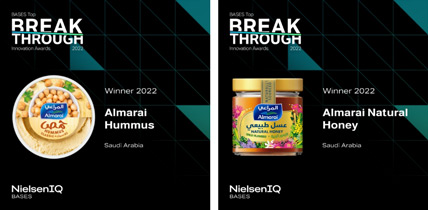

In 2022 we received a significant endorsement, earning the NielsenIQ BASES Breakthrough Innovation Award for our Hummus and Honey products that were launched in 2021. Almarai Hummus received Superstar recognition for “potential, incrementality, distinction, and endurance”.

Dairy in 2023

Building on the successful strategic programme followed this year, we will keep strengthening our value share and leadership positions in core segments in 2023. This will include investing in further packaging upgrades as well and enhancing accessibility, driving efficiency in the value chain, and focusing on communication.

Our strategy to accelerate performance in under-indexed segments and to target new segments will continue. We will support these activities by identifying attractive, profitable opportunities and investing in capacity and distribution. We will also pursue further efficiencies by recalibrating less profitable segments and channels.

(SAR million)

Almarai’s Beverages business unit grew ahead of its category in 2022, increasing value share thanks to the consistent implementation of its strategy to continue growing values ahead of the market in existing categories via Revenue Growth Management (RGM) and consumer innovations, while also expanding into new categories.

While revenue growth in Beverages was higher than 2021, margin growth reflected industry-wide higher input costs that affected the entire category.

After a difficult 2021, the current year was distinguished by similar and new challenges. Supply chain disruptions, the ongoing impact of the COVID-19 pandemic, and the conflict in Europe led to steep price increases in raw materials and other operating costs.

Solid Growth in a Tough Market

With all industry participants facing the same difficulties, competition was again robust. We persisted with our strategy, which helped us retain and grow our lead in the fresh and concentrated juices category while avoiding a price war to secure volume growth.

As of year-end 2022, our market share on juices is 41.4%, which represents an increase of 0.3% compared to the previous year.

In carton juices, our strong proposition with no added sugar and our commercial strategy resulted in 13.1% volume share, an increase of 4.9% compared to 2021.

Farm’s Select maintained its leadership position in the super premium segment, driving higher Retail Sales Price (RSP) vs. Juice category (2.5 times vs. market average), despite our main competitors promoting aggressively to try to secure market share.

| Juice Volume Shares | 42.9% |

| Juice Value Share | 41.4% |

| Household Penetration | 78.5% |

| Household Frequency | 14.0% |

Innovation is in our DNA

In line with our strategy, we expanded Beverages in 2022 to cater to new consumer needs as well as opportunities arising from the expansion of the occasions segment.

Alongside new juices, like Almarai Refresh range and carton juices with milk, a wider range of ready-to-drink (RTD) coffees and teas joined our portfolio of nutritious products, as did high protein milks and several plant-based milks for consumers wanting dairy alternatives.

In a very competitive beverages market, product expansion is key to our growth strategy. Innovation ensures that we maintain and grow our lead over our competitors.

Accordingly, we will continue to strengthen our portfolio with new beverage choices and recipe optimization in response to changing consumer demand.

Award-winning Promotions

We are very pleased to be recognized for our innovative approaches with a SMARTIES Gold Award for Almarai Long Life Juice’s influencer marketing campaign, and a SMARTIES Bronze for Farm’s Select Smoothies location-based targeting campaign.

In addition, Farm’s Select won the NielsenIQ BASES breakthrough innovation award. Almarai Long Life Juices’ digital campaigns also took home one Gold and two Bronzes at the MENA Effie Awards.

During 2022 we built on the successes achieved in the previous year from our ROI-based promotion strategy to grow revenues and market share.

Beverages in 2023

Conditions in our category will remain challenging in 2023, which further validates our proven strategy to evolve our portfolio. We will identify new categories and products that appeal to our consumers, and which deliver volumes, revenue, and sustainable growth.

(SAR million)

Almarai’s market-leading range of fresh whole chickens and related value-added products reported solid increases in volumes and margin in 2022.

Investment in production, regional economic recovery, and the implementation of accelerated demand generation strategies delivered healthy growth in Retail and Foodservice, and helped to offset higher industry-wide input costs.

New production capacity and demand generation boosted sales volumes in Retail and Foodservice, which ended the year 21.2% and 7.9% higher respectively.

Our performance in 2022 further entrenched our role as a national champion supporting the Kingdom’s Vision 2030 to raise local poultry production as a key part of its food security policies.

Almarai Poultry’s market share value across all retail channels in the Kingdom’s fresh poultry segment was 33.6% compared to the previous year’s 32%, and our ALYOUM brand maintained its first place ranking in the market with a solid consumer awareness score of 92%.

As our other GCC markets recovered to pre-pandemic levels, we accelerated demand generation to grow our leadership positions. In 2022, our market share volume in Kuwait and the UAE increased to 75.9% and 19.3% respectively.

New Capacity drives Record Volumes

Almarai commenced operations on its fourth processing line during the year under review. The new line, which will process 50 million birds when fully operational, aims to increase our total capacity by 25% to 250 million birds.

Higher production that was supported by continuing optimization and efficiency programmes resulted in volumes rising 13.8% to a record 183,902 metric tons (MT), culminating in robust revenue growth of 32.3%. While margins improved to 45.5%, segment profitability growth of 39.3% reflected the impact of cost inflation in feed stock and transportation.

Expansion Programme contributes to Vision 2030 Food Security Goals

Production facilities in Hail region were completed this year for full deployment in 2023. Furthermore, we announced land signings in the Alshamli-Hail region for a new facility with a capacity of 150 million birds, while in Al-Jouf, we initiated projects to increase our hatching capacity by 150 million eggs. All these projects are part of the SAR 6.6 billion investment, announced in 2021, that is designed to double Almarai’s poultry capacity.

Phased investments in different regions in Saudi Arabia will support accelerated growth and ensure we remain on track to achieve our expansion targets. As we strengthen the resilience of our Poultry business by enabling full vertical integration of supply, Almarai will continue making a meaningful contribution to the Kingdom’s commitment to self-sufficiency.

by Volume

ALYOUM Marinated Whole Chicken Biryani

ALYOUM Marinated Whole Chicken Mandi

ALYOUM Sambosa filling

Leading the way in Animal Care

We were pleased to announce during 2022 that Almarai was the first company in Saudi Arabia to be certified by NSF International in poultry hatchery, transport, and operations, according to international animal wellness standards.

This important recognition validates Almarai’s commitment to animal health and care, and ensures that we deliver the best products to the millions of consumers who trust our brand.

Award-winning Innovation Boosts Performance

Product innovation, accelerated demand generation, and enhanced production and distribution all contributed to strong volume growth in our Retail channel compared to 2022. This was a particularly strong performance given that last year Retail had surpassed pre-COVID-19 volumes.

The Ready-to-Cook portfolio was expanded to include limited edition pre-marinated products, offering traditional flavors that consumers love and enjoy in their daily meals and on special occasions.

ALYOUM Marinated products are distributed in the KSA and Kuwait across all retail channels.

ALYOUM Marinated Whole Chickens was the preferred choice for consumers in the KSA in 2022, achieving 36.5% market share volume, 13 basis points higher than the second largest player.

Engaging communication campaigns were created to promote these limited-edition products, which will continue to add excitement to this new portfolio and further develop the Ready-to-Cook category. These seasonal products will also feature in ALYOUM’s core portfolio in the future, subject to consumer demand.

ALYOUM continued to enhance the shopping experience across all retail channels with appealing innovations, customer-friendly packaging, improved category navigation, and in-store activities in partnership with retailers. These initiatives supported ALYOUM’s 21.2% volume growth in retail in 2022, and helped further consolidate brand preference, which surged to 78% from 71% in 2021.

In 2022, Nielsen’s IQ Bases awarded ALYOUM Marinated Whole Chicken as one of Saudi Arabia’s “Breakthrough Innovations”.

Supporting Growth in Foodservice

During 2022, we also accelerated demand generation strategies in our Foodservice division, Almarai Pro, resulting in a healthy 7% increase in sales volumes. We continue to support customers who opt for fresh poultry over frozen birds by consistently delivering quality products every day.

Almarai Poultry in 2023

In 2023, rising capacity and a continuing focus on efficiency will underpin our growth strategies in all channels and our commitment to consistent delivery of quality poultry to customers and consumers. Notwithstanding forecast sustained cost inflation in feed and energy, we are unwavering in our ability to deliver profitable growth across all channels, ensuring that we meet our robust expansion targets.

(SAR million)

Our Bakery business provides quality, nutritious breads, snacks, and treats that enrich consumers’ lives every day. It performed exceptionally well in 2022, with revenues topping SAR 2 billion for the first time. We also grew our contribution to Almarai’s total income, remaining the second largest contributor to the Group margin after the Dairy business.

Double digit growth in volume, revenue, margins and earnings before interest and tax were driven by our continued focus on trade execution and brand marketing to ensure our products are easily accessible and front of mind with consumers across our markets.

Trading conditions in the region returned to normal in 2022 after COVID-19 restrictions eased. The resumption of travel and schools re-opening lifted demand for our higher margin single-serve products. Our snacking portfolio performed particularly well, with revenue of SAR 2,439 million rising 36.4%, contributing extensively to Bakery’s overall margin growth.

We are particularly pleased with our new acquisition, Bakemart, which is already profitable following an accelerated turnaround. Adding Bakemart to our stable of brands provides valuable knowledge and access to the UAE, and a new channel to supply frozen foods and other products to Foodservice.

Bakery’s strong performance in 2022 reflected its larger share of the market in all relevant categories. Our brands L’usine and 7DAYS did particularly well, expanding their overall market share from 54% to 56% in Saudi Arabia. L’usine, which offers savory and sweet baked goods, remained at number one in KANTAR’s Brand Footprint survey in the Kingdom, and fourth in the UAE.

Consistent and creative consumer marketing remained an essential business investment to support and build brand loyalty. Both L’usine and 7DAYS received awards during the year with the former earning the Smarties Gold award for L’usine Puffs Campaign. L’usine also took home the NielsenIQ BASES Packaging Design Impact Award for its Multigrain bread.

7DAYS, which produces a wide variety of croissants, cakes, strudel, and bake rolls, received a Smarties Bronze for its Mini Croissant Campaign.

Like most industries, we were affected by the global supply chain disruptions in 2022 that caused the cost of raw materials to increase. In response, we improved our cost per unit with economies of scale in manufacturing, and increased prices in the first quarter.

Dates and Fruits Puff

Plain Brioche Sandwich Rolls

Tortilla Wraps BIF

Chocolate Brownie

Traditional Cakes

7DAYS Enrobed Cakes

7DAYS Mini Croissant

7DAYS Bake Roll Tomato

Expanding Product Lines and Geographical Markets

We maintained our strategic focus on converting unpackaged bakery to packaged bakery products and growing our market share in existing and new categories. We also branched out regionally in 2022, expanding store presence in Oman by introducing extended shelf life breads, and launching in Jordan with the same bread products and related treats.

The Bakemart acquisition has expanded our footprint to the UAE and other GCC markets. Its outstanding assortment and opportunities for innovation will drive growth, while the additional capacity it brings will provide us with new platforms for expansion.

Bakery in 2023

Our focus next year is to maintain and grow our leadership position in all our main market segments in the Kingdom, and grow demand for our products in the other GCC countries where we have a footprint. We will also concentrate on expanding our wholesale business (Win in trade). In line with our successful innovation strategy, we will also launch a range of new products across main categories and markets.

(SAR million)